What Is Book Value?

The book value of a company is defined as the total value of the company’s assets minus the total liabilities that the company has to pay for. In other words, it is the difference between the company’s assets and liabilities stated on the balance sheet of the business.

Book value plays an important role for many investors as it is used as a key measure of a company’s pure value according to its books. If a business was liquidated, the book value would represent the value of all the assets, that shareholders would theoretically receive.

The formula of book value goes as follows:

If company A has total assets of $80 million and total liabilities of $30 million, its according book value would be $50 million.

In some cases, the book value of a business can be negative, meaning that the total liabilities of the business exceed the total assets. A negative book value should raise a red flag for investors as that would indicate balance sheet insolvency.

- Book value represents the total worth of the company’s assets if the business was liquidated and liabilities were paid back.

- Market value is the total value of the company according to financial markets. Market value is also often referred to as market capitalization. The market value of most companies is usually higher than the book value.

How to Calculate Book Value

You can calculate the book value of a business by locating the assets and liabilities of the company’s balance sheet.

Then, simply subtract the total liabilities from the company’s total assets. The book value should be the same as shareholders’ equity, which is stated at the bottom of the balance sheet.

Example

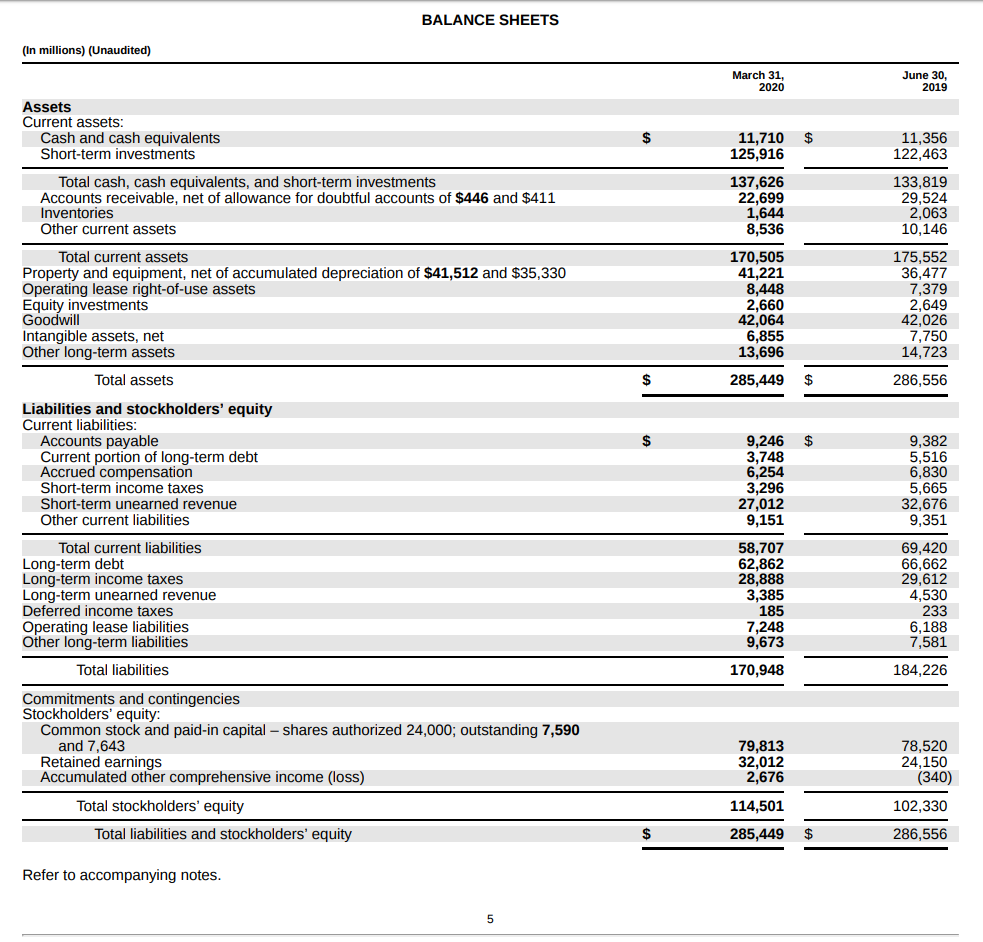

Here is a screenshot of the recent balance sheet of Microsoft (MSFT) from its 10-Q for the quarter that ended in March 2020.

Source: Microsoft Investor Relations

Microsoft’s total assets for the quarter were roughly $285.45 billion, while total liabilities were at around $170.95 billion. Subtracting all liabilities from the total assets would result in book value for the company of $114.50 billion.

Oftentimes, book value is referred to as the book value on a per-share basis. In order to calculate the book value of each share, simply divide the book value (equity) of the business by the number of outstanding shares.

As of July 2020, Microsoft has roughly 7.59 billion shares outstanding. If we divide the total book value of the company of $114.50 billion by the number of shares outstanding, we would come up with a book value per share of approximately $15.09.

Companies can increase their book value from generating higher profits and using those profits to either buy more assets (such as inventory, property, and financial investments) or decrease the liabilities (like paying down debt and other lease obligations). Both types of actions would result in a bigger difference between total assets and liabilities and thus a higher book value.

Why Is Book Value Important?

Investors often analyze book value in relation to the company’s current market value in order to gauge the value of a company. This is where the price-to-book (P/B) ratio comes into place.

The price-to-book ratio is a valuation metric that can be useful when comparing similar companies that are operating within the same industry to determine which company may have better value.

A low P/B ratio may indicate an undervalued company, while a higher P/B ratio can suggest that a business might be overvalued.

What the price-to-book ratio really does is showing how much book value investors would get from a business for the current market price.

You could also compare the current P/B ratio of a stock with its own historical standards, to see how the business is currently priced in contrast to its past values.

The price-to-book ratio can be calculated by dividing the current stock price by its book value per share.

If we go back to our example above, we could determine the P/B ratio of Microsoft to get a better view of where the company’s price is currently standing.

As of July 15th, Microsoft’s stock is trading at $208 per share. Dividing the share price by the book value that we calculated above ($15.09) would result in a price-to-book (P/B) ratio of 13.81 for the stock, which is relatively high if we compare that number with the company’s past records.

Note that the P/B ratio on its own won’t be enough to determine a company’s value.

Just like any other valuation metric, the price-to-book ratio can quickly be calculated and analyzed but also comes with certain flaws, which make it a relatively vague indicator that should only be used along with other valuation metrics and approaches.